Georgia Film Tax Credit Requirements . The georgia department of economic development (gdecd) certifies projects that meet the qualifications for the film tax. learn more about required mandatory film tax credit audit & fees; for feature films, television movies, pilots, series, and music videos, if applying for the full 30% tax credit, the applica on package. Voluntary film tax credit for productions. mandatory film tax credit audit & fees. the georgia entertainment industry investment act grants an income tax credit of 20% to qualified productions which. for a project to be eligible for the 20% transferable tax credit, the georgia department of economic development. georgia offers a 20% tax credit on qualified production expenditures for film and television projects.

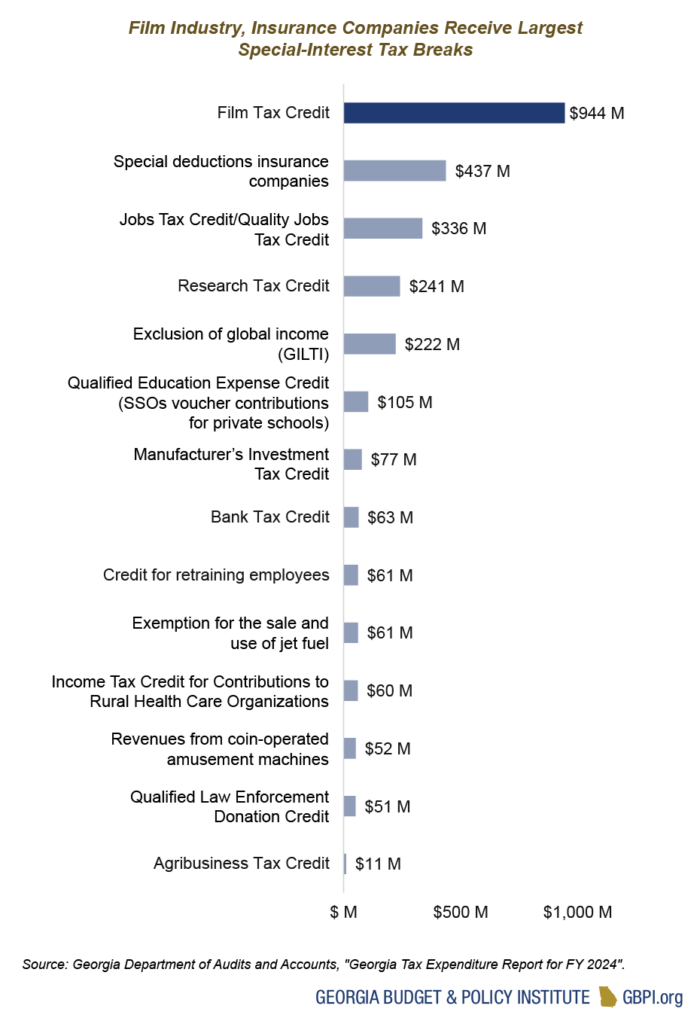

from gbpi.org

georgia offers a 20% tax credit on qualified production expenditures for film and television projects. the georgia entertainment industry investment act grants an income tax credit of 20% to qualified productions which. mandatory film tax credit audit & fees. learn more about required mandatory film tax credit audit & fees; The georgia department of economic development (gdecd) certifies projects that meet the qualifications for the film tax. for feature films, television movies, pilots, series, and music videos, if applying for the full 30% tax credit, the applica on package. Voluntary film tax credit for productions. for a project to be eligible for the 20% transferable tax credit, the georgia department of economic development.

Budget Trends Primer for State Fiscal Year 2024 Budget and Policy Institute

Georgia Film Tax Credit Requirements for a project to be eligible for the 20% transferable tax credit, the georgia department of economic development. mandatory film tax credit audit & fees. for a project to be eligible for the 20% transferable tax credit, the georgia department of economic development. georgia offers a 20% tax credit on qualified production expenditures for film and television projects. for feature films, television movies, pilots, series, and music videos, if applying for the full 30% tax credit, the applica on package. learn more about required mandatory film tax credit audit & fees; the georgia entertainment industry investment act grants an income tax credit of 20% to qualified productions which. The georgia department of economic development (gdecd) certifies projects that meet the qualifications for the film tax. Voluntary film tax credit for productions.

From www.johnlocke.org

Audit wallops film tax credits Georgia Film Tax Credit Requirements learn more about required mandatory film tax credit audit & fees; georgia offers a 20% tax credit on qualified production expenditures for film and television projects. Voluntary film tax credit for productions. for a project to be eligible for the 20% transferable tax credit, the georgia department of economic development. The georgia department of economic development (gdecd). Georgia Film Tax Credit Requirements.

From www.audits2.ga.gov

Tax Incentive Evaluation Film Tax Credit DOAA Georgia Film Tax Credit Requirements for a project to be eligible for the 20% transferable tax credit, the georgia department of economic development. learn more about required mandatory film tax credit audit & fees; georgia offers a 20% tax credit on qualified production expenditures for film and television projects. Voluntary film tax credit for productions. the georgia entertainment industry investment act. Georgia Film Tax Credit Requirements.

From www.wrapbook.com

How to Leverage Film Tax Credits Wrapbook Georgia Film Tax Credit Requirements Voluntary film tax credit for productions. mandatory film tax credit audit & fees. learn more about required mandatory film tax credit audit & fees; the georgia entertainment industry investment act grants an income tax credit of 20% to qualified productions which. georgia offers a 20% tax credit on qualified production expenditures for film and television projects.. Georgia Film Tax Credit Requirements.

From wifeys-26h58o.blogspot.com

film tax credit application Foramen EJournal Portrait Gallery Georgia Film Tax Credit Requirements for a project to be eligible for the 20% transferable tax credit, the georgia department of economic development. The georgia department of economic development (gdecd) certifies projects that meet the qualifications for the film tax. Voluntary film tax credit for productions. mandatory film tax credit audit & fees. learn more about required mandatory film tax credit audit. Georgia Film Tax Credit Requirements.

From www.rosalesfinancialgroup.com

Film Tax Credit — Rosales Financial Group Georgia Film Tax Credit Requirements mandatory film tax credit audit & fees. learn more about required mandatory film tax credit audit & fees; the georgia entertainment industry investment act grants an income tax credit of 20% to qualified productions which. for a project to be eligible for the 20% transferable tax credit, the georgia department of economic development. The georgia department. Georgia Film Tax Credit Requirements.

From variety.com

Film Tax Credit Could Be Capped Amid Fiscal Crisis Georgia Film Tax Credit Requirements The georgia department of economic development (gdecd) certifies projects that meet the qualifications for the film tax. for a project to be eligible for the 20% transferable tax credit, the georgia department of economic development. mandatory film tax credit audit & fees. for feature films, television movies, pilots, series, and music videos, if applying for the full. Georgia Film Tax Credit Requirements.

From tysonbarlow.blogspot.com

film tax credit history Tyson Barlow Georgia Film Tax Credit Requirements learn more about required mandatory film tax credit audit & fees; the georgia entertainment industry investment act grants an income tax credit of 20% to qualified productions which. georgia offers a 20% tax credit on qualified production expenditures for film and television projects. mandatory film tax credit audit & fees. Voluntary film tax credit for productions.. Georgia Film Tax Credit Requirements.

From risingdemons-fallensaints.blogspot.com

film tax credit requirements Charmer Blogsphere Image Library Georgia Film Tax Credit Requirements Voluntary film tax credit for productions. The georgia department of economic development (gdecd) certifies projects that meet the qualifications for the film tax. for feature films, television movies, pilots, series, and music videos, if applying for the full 30% tax credit, the applica on package. the georgia entertainment industry investment act grants an income tax credit of 20%. Georgia Film Tax Credit Requirements.

From saturation.io

Film Tax Credit Saturation Georgia Film Tax Credit Requirements Voluntary film tax credit for productions. mandatory film tax credit audit & fees. The georgia department of economic development (gdecd) certifies projects that meet the qualifications for the film tax. georgia offers a 20% tax credit on qualified production expenditures for film and television projects. for feature films, television movies, pilots, series, and music videos, if applying. Georgia Film Tax Credit Requirements.

From saturation.io

Film Tax Credit Saturation Georgia Film Tax Credit Requirements for a project to be eligible for the 20% transferable tax credit, the georgia department of economic development. Voluntary film tax credit for productions. mandatory film tax credit audit & fees. for feature films, television movies, pilots, series, and music videos, if applying for the full 30% tax credit, the applica on package. learn more about. Georgia Film Tax Credit Requirements.

From fabalabse.com

How does the film tax credit work? Leia aqui What are the rules for the film tax credit Georgia Film Tax Credit Requirements the georgia entertainment industry investment act grants an income tax credit of 20% to qualified productions which. The georgia department of economic development (gdecd) certifies projects that meet the qualifications for the film tax. learn more about required mandatory film tax credit audit & fees; for a project to be eligible for the 20% transferable tax credit,. Georgia Film Tax Credit Requirements.

From www.youtube.com

GA Film Tax Credit Explained YouTube Georgia Film Tax Credit Requirements for a project to be eligible for the 20% transferable tax credit, the georgia department of economic development. The georgia department of economic development (gdecd) certifies projects that meet the qualifications for the film tax. learn more about required mandatory film tax credit audit & fees; mandatory film tax credit audit & fees. the georgia entertainment. Georgia Film Tax Credit Requirements.

From www.bizjournals.com

film tax credit program needs more oversight, new audit finds Atlanta Business Chronicle Georgia Film Tax Credit Requirements mandatory film tax credit audit & fees. The georgia department of economic development (gdecd) certifies projects that meet the qualifications for the film tax. learn more about required mandatory film tax credit audit & fees; the georgia entertainment industry investment act grants an income tax credit of 20% to qualified productions which. Voluntary film tax credit for. Georgia Film Tax Credit Requirements.

From tysonbarlow.blogspot.com

film tax credit history Tyson Barlow Georgia Film Tax Credit Requirements for a project to be eligible for the 20% transferable tax credit, the georgia department of economic development. learn more about required mandatory film tax credit audit & fees; the georgia entertainment industry investment act grants an income tax credit of 20% to qualified productions which. for feature films, television movies, pilots, series, and music videos,. Georgia Film Tax Credit Requirements.

From www.wrapbook.com

Essential Guide Film Tax Credits Wrapbook Georgia Film Tax Credit Requirements mandatory film tax credit audit & fees. Voluntary film tax credit for productions. georgia offers a 20% tax credit on qualified production expenditures for film and television projects. The georgia department of economic development (gdecd) certifies projects that meet the qualifications for the film tax. learn more about required mandatory film tax credit audit & fees; . Georgia Film Tax Credit Requirements.

From demetralarose.blogspot.com

film tax credit 2021 Demetra Larose Georgia Film Tax Credit Requirements The georgia department of economic development (gdecd) certifies projects that meet the qualifications for the film tax. the georgia entertainment industry investment act grants an income tax credit of 20% to qualified productions which. for a project to be eligible for the 20% transferable tax credit, the georgia department of economic development. learn more about required mandatory. Georgia Film Tax Credit Requirements.

From fabalabse.com

How does the film tax credit work? Leia aqui What are the rules for the film tax credit Georgia Film Tax Credit Requirements for a project to be eligible for the 20% transferable tax credit, the georgia department of economic development. mandatory film tax credit audit & fees. Voluntary film tax credit for productions. learn more about required mandatory film tax credit audit & fees; The georgia department of economic development (gdecd) certifies projects that meet the qualifications for the. Georgia Film Tax Credit Requirements.

From saturation.io

Film Tax Credit Saturation Georgia Film Tax Credit Requirements Voluntary film tax credit for productions. the georgia entertainment industry investment act grants an income tax credit of 20% to qualified productions which. mandatory film tax credit audit & fees. The georgia department of economic development (gdecd) certifies projects that meet the qualifications for the film tax. for feature films, television movies, pilots, series, and music videos,. Georgia Film Tax Credit Requirements.